REVERSAL CANDLES

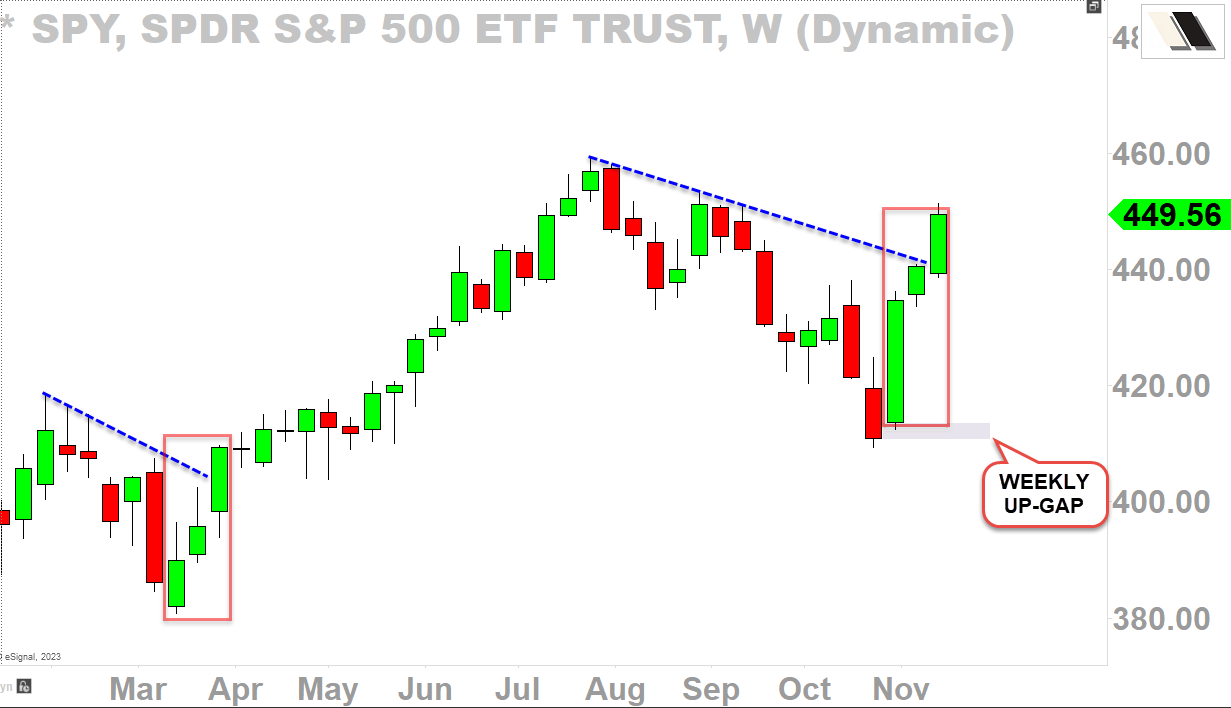

The Three White Soldiers (weekly candles) are here.

Witnessing, these, consecutive, three weeks of bullish candles are rare especially after a steep decline we’ve seen last few months (because the market, typically, don’t go straight up during reversal). And, on top of that, clearing above the falling resistance (dotted blue) just adds to the strong bullish aroma flaring through out the market in the last three consecutive-weeks; not to mention the “WEEKLY UP-GAP (still open-see chart below)” right at the bottom (weekly up-gap can only be seen if the gap was initiated on Monday morning).

If these strong bullish candles showed up after a prolong rally, I would say that’s a signal for the market is topping out; but when they show up after a steep correction (like we’ve seen last three months), this is a strong reversal signal that could carry another 2-3 months of bullish run (with fluctuations & shenanigans along the way).

NEW TREND DEVELOPMENT

Prior resistance becoming a new support is a major tell-tell signal.

First step is to break above the long-term MA (dotted purple–see May/June this year 👇) to break the downside momentum; and then, subsequently, market would want to retest that MA before the trend can be FULLY reversed (because head-fakes and shenanigans is a norm in this game).

While the market is in a major downtrend swing, you will see that my long-term MA will be breached to the downside (See April/May of 2022) and will act as resistance on the bear-market rallies (see red arrows). However, once the MA is reclaimed and the market is preparing to establish a new uptrend, the MA (that used to be a resistance) is retested to see if it really does have an ‘impressive resume’ and become the new support (green arrows).

So what happened at this level?

Well, the market bounced (see the chart below).

We’ve been above this long-term MA for the last three straight weeks now. This signal alone contributes heavily to the idea that the market is preparing for a major-full reversal to develop a new uptrend. Yes, it means, we have high probability that the market is preparing for the new all-time highs and beyond.

Let’s check out that oscillator.

👇 The analysis regarding to this MA (chart above) and the oscillator hitting the extreme oversold zone (at that time the oscillator wasn’t crossed-up yet)

OSCILLATOR CROSS

The oscillator that called major lows in the past, the same signal flares today.

As you can see below, the oscillator has now fully crossed-up similar to 2019 lows and 2020 lows. You might ask, well, we did see many whipsawing-action (from the oscillator) during 2022 (See Xs). Yes, that is true (see Xs). But look at how the oscillator behaved during the downturn of 2022 (see Xs again).

The oscillator did not see that water-fall like move similar to 2019 and 2020; but here in 2023, finally, we got the water-fall like action on the oscillator. And now fully crossed up.

- 2019 lows to 2020 peak = +45%

- 2020 lows to 2021 peak = +115%

- 2023 lows to 2024 peak = ???

FORECAST

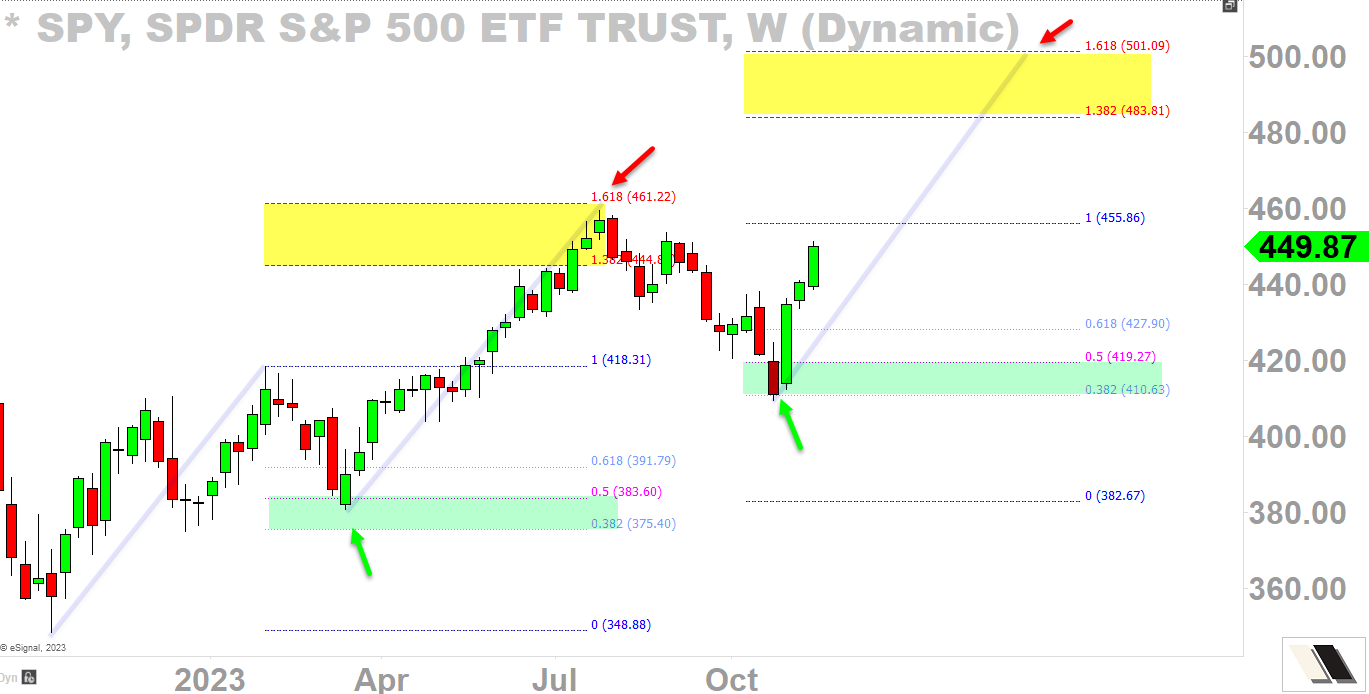

Analysis combining Fibonacci Extension with Wave Targeting:

2023 April To July Run

- Price bottomed during 2023 March–it did so in between my Fib Retracement zone 38.2%-50% (SPY380)

- Price advanced until it hit my Fib Extension zone 161.8% (SPY 461)

- We witnessed -10% correction from the 161.8% Extension (SPY 461) resistance to the next Retracement (SPY 410)

2023 November To Feb Run?

- Price bottomed during 2023 late-October–it did so in the last level of my Fib Retracement zone 38/2% (SPY 410) 👈 Remember, this level also coincides with my long-term MA and the oscillator extreme oversold

- FORECAST: Price could continue to advance (with fluctuations/shenanigans along the way) until it hit my Fib Extension zone 161.8% (SPY 500)

👇 I WILL REPLY TO ALL QUESTIONS BELOW (*NO LOGIN REQUIRED)